Schedule M-1 2024 Explanation Attachment

If you are searching about Schedule M-1 | robergtaxsolutions.com you’ve visit to the right place. We have 15 Pics about Schedule M-1 | robergtaxsolutions.com like Schedule M-1 | robergtaxsolutions.com, IRS 1120-F – Schedule M-1 & M-2 2020 – Fill out Tax Template Online and also Schedule M-T Note: The corporation may be required to | Chegg.com. Read more:

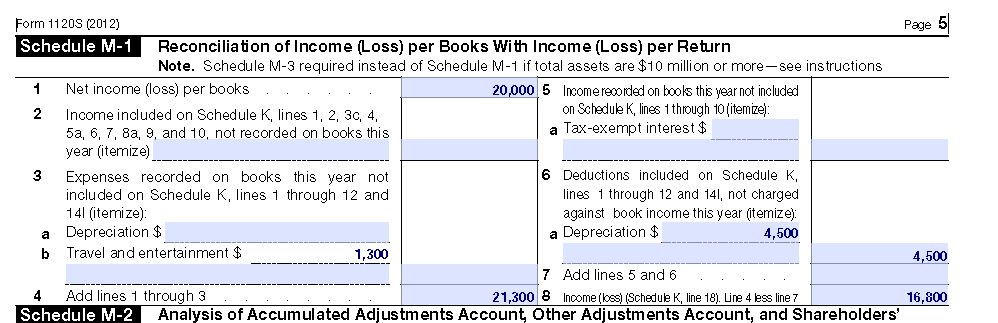

Schedule M-1 | Robergtaxsolutions.com

Photo Credit by: robergtaxsolutions.com schedule m1 tax return depreciation entertainment profit income meal tag shown items

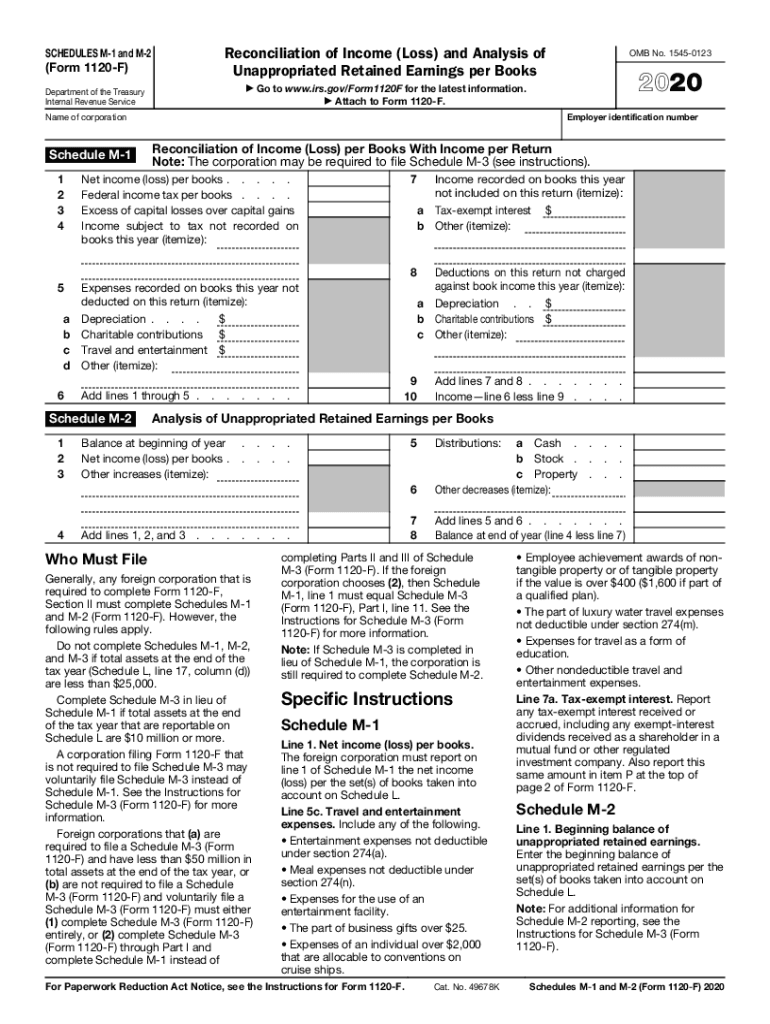

IRS 1120-F – Schedule M-1 & M-2 2020 – Fill Out Tax Template Online

Photo Credit by: www.uslegalforms.com 1120 irs reconciliation retained earnings pdffiller templateroller forms

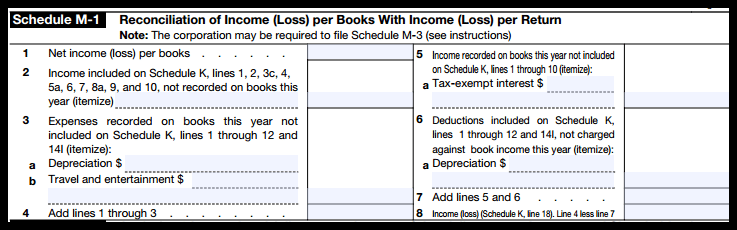

What Is Form 1120S And How Do I File It? | Ask Gusto

Photo Credit by: gusto.com 1120s gusto instructions

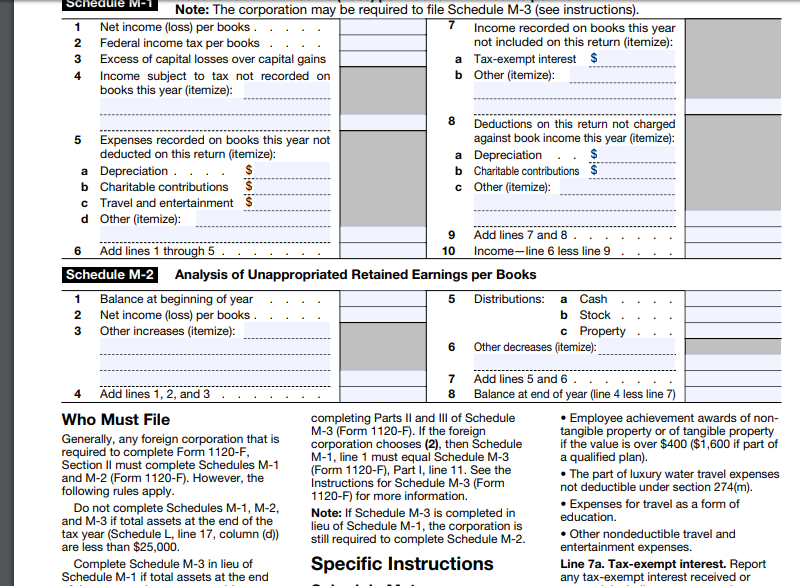

Schedule M-T Note: The Corporation May Be Required To | Chegg.com

Photo Credit by: www.chegg.com

How To Complete Form 1120S: Income Tax Return For An S Corp

Photo Credit by: fitsmallbusiness.com form 1120s schedule income irs return loss per tax reconciliation books corp complete fitsmallbusiness

1120 – Calculating Book Income, Schedule M-1 And M-3 (K1, M1, M3)

Photo Credit by: kb.drakesoftware.com 1120 income book schedule m1 line m3 sch calculating corporation reported financial subtract match

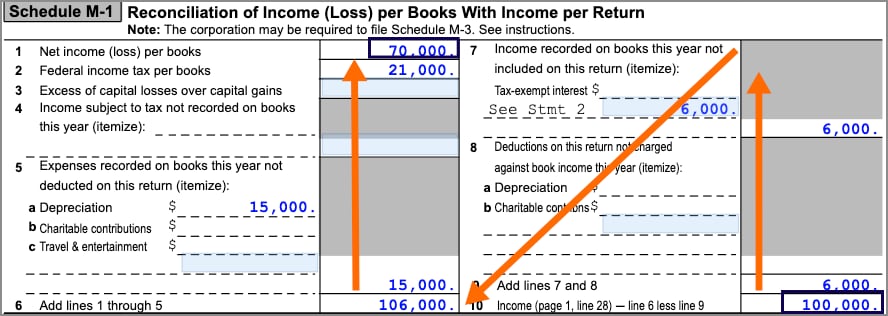

Prepare A Schedule M-1, Page 5, Form 1120, Reconciling Cramer’s Book

Photo Credit by: www.homeworklib.com schedule 1120 form prepare income cramer taxable reconciling book corporation calendar homeworklib reconciliation

1120 – Calculating Book Income, Schedule M-1 And M-3 (K1, M1, M3)

Photo Credit by: kb.drakesoftware.com 1120 income book schedule m1 line m3 sch part calculating column following which ii

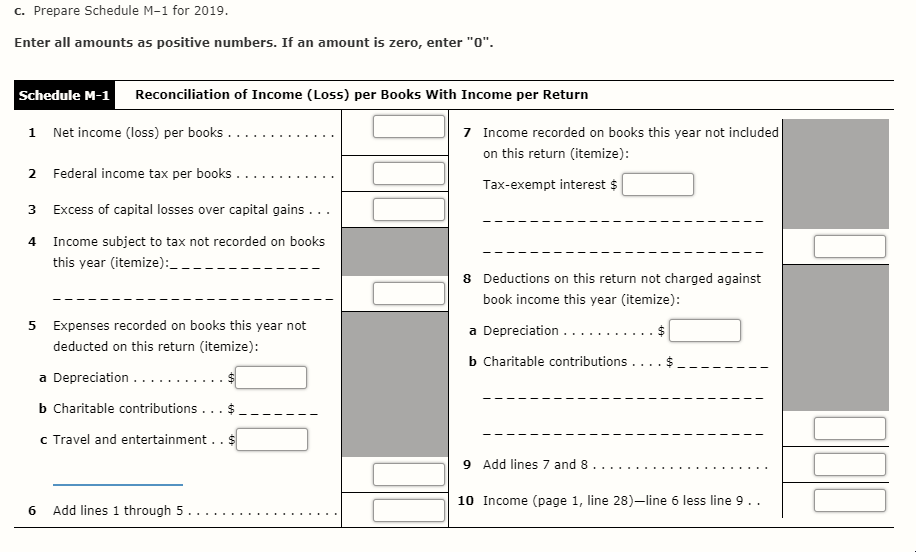

The Following Information For 2019 Relates To | Chegg.com

Photo Credit by: www.chegg.com

1065 – Calculating Book Income, Schedules M-1 And M-3 (K1, M1, M3)

Photo Credit by: kb.drakesoftware.com 1065 income book calculating m1 line m3 schedule schedules partnership k1 sch amount reported should add

What Is The Purpose Of Schedule M-1 On Form 1120? – YouTube

Photo Credit by: www.youtube.com 1120

Solved Assignment Choice #2: M-1 And M-2 Calculations Part | Chegg.com

Photo Credit by: www.chegg.com schedule requirements form

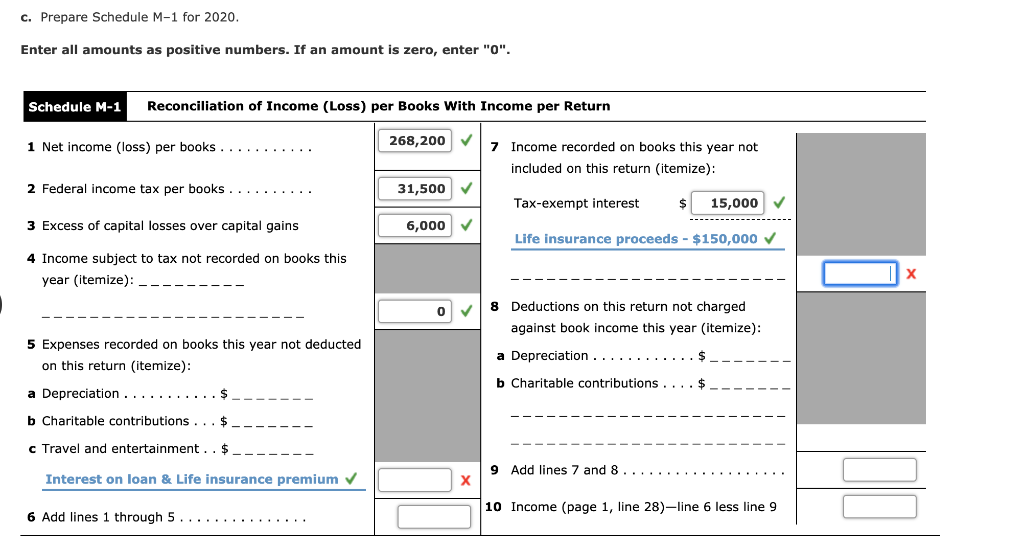

Solved Emerald Corporation, A Calendar Year And Accrual | Chegg.com

Photo Credit by: www.chegg.com year accrual corporation calendar help solved schedule rest please figure taxpayer provides prepare following information

Can You Take Home Office Deduction On 1120S

Photo Credit by: alishamorenodesigns.blogspot.com income 1120s drakesoftware

How Is Retained Earnings Calculated On Form 1120?

Photo Credit by: proconnect.intuit.com 1120 earnings retained intuit return generates computation

Schedule M-1 2024 Explanation Attachment: Schedule m-1. How is retained earnings calculated on form 1120?. What is form 1120s and how do i file it?. 1120 irs reconciliation retained earnings pdffiller templateroller forms. Schedule 1120 form prepare income cramer taxable reconciling book corporation calendar homeworklib reconciliation. Schedule requirements form